A Deep Dive Into ChartHop

This is my published memo for Contrary Research on ChartHop. You can find the memo here, or read it below.

For my next piece, I’m working on a deep dive into embedded finance/BaaS and would love to connect with anyone building/investing in the space – feel free to reach out via Twitter or email!

Thesis

In 1987, the first-ever client-server human resource management system (HRMS) for the HR industry was released. The launch of PeopleSoft, a small startup based out of California, marked the first major breakthrough in the world of HR software, sparking the creation of a multi-billion-dollar industry. Until PeopleSoft, organizations relied on large, centralized mainframe computers to handle their computing needs for HR-related activities. While powerful, these mainframes were expensive and often required dedicated IT staff and infrastructure to maintain. This centralized model limited the accessibility and scalability of HR technology.

But, in 1987, this all changed – the first generation of HR software was born.

Instead of utilizing centralized computers, PeopleSoft built a distributed computing model that allowed HR processes to be spread out across multiple smaller, more inexpensive computers. Shortly after, other vendors, such as SAP and Oracle, followed suit, building their own client-server systems.

With the introduction of Enterprise Resource Planning (ERP) systems in the 1990s, these new distributed software platforms integrated HR with various functions, from operations to finance, into a single, unified platform. These integrations allowed organizations to break down data silos and create a seamless flow of information across different departments. For HR, this meant that processes such as payroll, benefits administration, and personnel tracking could be managed within the same system as other core business operations.

Then, in the 2000s, a second generation of HR software emerged. As the world shifted to cloud computing, HR software transitioned from on-premise solutions to cloud-based platforms. This shift redefined the way HR functions were managed, eliminating the need for in-house infrastructure. As the cloud made inroads, HR leaders also began to “adopt a new, one-stop-shopping breed of technology known as the HCM suite”. The HCM suite focused on building bridges between data across various HR functions, enabling organizations to gain insights into workforce trends, performance metrics, and employee engagement.

Yet, despite the underlying catalysts of cloud computing and machine learning, HR software was historically avoided by many investors in the early 2000s and 2010s. The reason for the lack of investment is that “a startup selling to HR departments or job seekers endured headwind after headwind”. Not only did HR teams typically have low internal budgets and influence, but the ROI on HR software has always been largely intangible, with success metrics being difficult to track accurately.

But, in 2020, the state of the world changed. As the pandemic reshaped the economy, the workplace was reinvented; employees were scattered across the globe, engagement reached all-time lows, and demand for flexible working environments and increased transparency grew considerably. Yet, existing HR was not purpose-built to suit this rapidly changing work dynamic; the majority of software still relied on spreadsheet-based solutions that were too static, preventing organizations from accurately measuring how their internal structure was changing from day to day.

This mismatch between demand and supply created an opportunity; a flow of investment into HR software occurred and a new generation of startups emerged, aiming to turn organizations into code. These startups shifted away from the static, annual analytical experiences that previous software provided and moved toward dynamic dashboards that pulled data from multiple sources in real-time.

Among these startups was ChartHop – a people’s operations platform.

ChartHop pulls together disparate data sources via integrations with company-wide systems such as payroll to help companies unlock previously hidden insights. By connecting previously siloed data sources in real-time, companies can map out the future of their organization and adapt to changing circumstances. As a result, instead of having to create pivot tables in Excel, executives can use ChartHop to map out the impact of proposed headcount changes across their whole organization, shifting HR software to focus on real-time data and company-wide insights.

Founding Story

ChartHop was cofounded in 2018 by Ian White. After graduating from Brown University with a degree in Computer Science, Ian worked as a developer for Music Nation and Money-Media before becoming Business Insider’s first “Head of Engineering” in 2008. At Business Insider, Ian helped architect the publishing platform that powers today’s highest-trafficked business website.

In 2010, White then founded Sailthru, an email personalization platform that grew to be used for sending 10 billion emails per month. It was able to achieve $20 million in revenue within its first three years, making Sailthru the 29th fastest-growing company on the Inc. 5000 list.

Yet, as Sailthru’s revenue was increasing month-over-month, its early HR processes started to break down, providing Ian with a unique insight into the challenges of a fast-growing startup:

“We had good software tools for every aspect of the business — except the people side. For some reason, people software is a backwater and everybody resorts to spreadsheets for anything serious. After I left Sailthru, I consulted with a number of organizations, big and small. I saw the same org management issues pop up again and again. The challenges we faced at Sailthru weren’t unique — they’re actually quite prevalent for every operating leader.”

Unlike server management software, there is no Datadog for people management; to access basic information about an organization, executives have to spend all day pulling information from their HRIS and building pivot tables in Google Sheets. Essentially, great software for understanding and managing people doesn’t exist. That’s why Ian began building the platform he wished he had when scaling Sailthru: ChartHop.

Instead of static spreadsheets that are used once a year, Ian’s goal was to build software that could turn an organization into code, enabling people leaders to visualize and model organizational changes, consequently leading to a more informed decision-making process.

After spending two years building the initial product, Ian began fundraising.

“I knew that to build an ambitious business, we would need external capital. Once I felt the product was ready, I was introduced to David Ulevitch, general partner at Andreessen Horowitz (a16z), and I demoed the product. The meeting was pretty casual — I didn’t have a pitch deck, I just shared the product and the vision. But, as a former operator, he immediately understood the need and potential for our solution.”

That meeting eventually led to Andreessen Horowitz leading ChartHop’s initial $5 million seed round in 2020 to build a modern people analytics platform. Today, ChartHop has expanded beyond people analytics, covering everything from compensation reviews to recruiter experiences.

“We started as a people analytics platform and what we’ve actually done is transitioned to being a people operations platform because people analytics and the data foundation is really core to what we do and is still a big piece of what we do. But the processes and operations that we support for the modern people ops leader goes well beyond just the analytics piece.”

Product

ChartHop is a people operations platform that acts as a single source of truth to unify an organization’s data on its workforce The platform centralizes data across HR and tech stacks by connecting key systems like an organization’s applicant tracking system (ATS) to compensation and performance data.

People Analytics

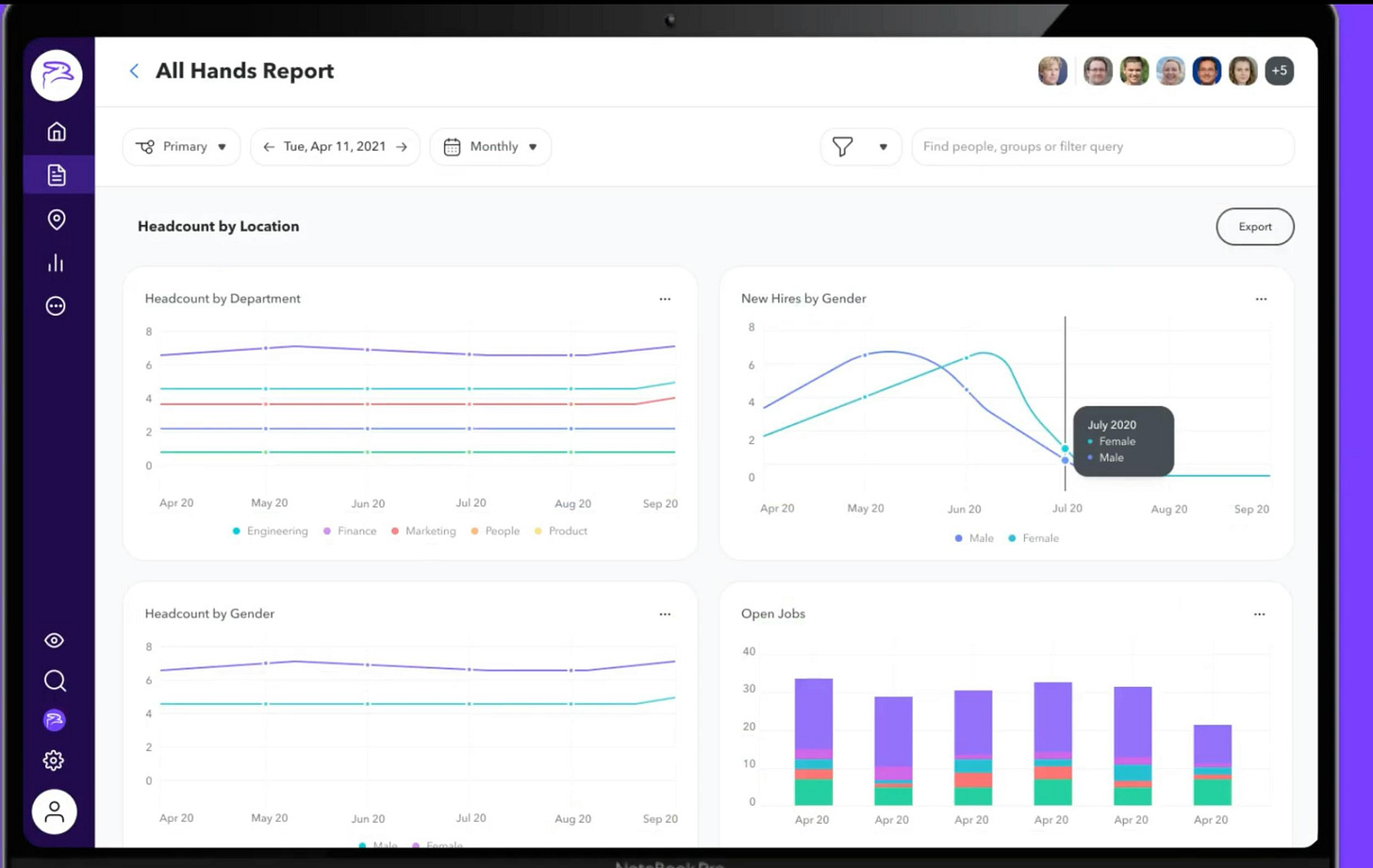

ChartHop’s People Analytics product creates a centralized place for aggregating people data and analysis. Through ChartHops integrations, it aggregates an organization's people data across multiple data sources to extract key insights and analytics. For example, companies can integrate their human resources information system (HRIS), applicant tracking system (ATS), payroll software, identity management software, and more with ChartHop.

From these integrations, ChartHop makes data more accessible. For example, if a company stored employees’ base pay in its payroll system, bonuses in a spreadsheet, and equity grants in Carta, it would not have a complete picture of how its employees are being compensated. As a result, it would be unable to analyze how compensation varies between departments, levels, and geographies. ChartHop unifies this data into an interactive dashboard to allow companies to compare metrics such as performance ratings with variables like compensation.

Further, ChartHop updates dynamically; no pull requests or manual data updates are required. Instead, data syncs automatically via ChartHop’s integrations, so reports are up-to-date. Given this, users can access real-time data, enabling them to alter decisions based on their changing organizational structure.

Org Chart

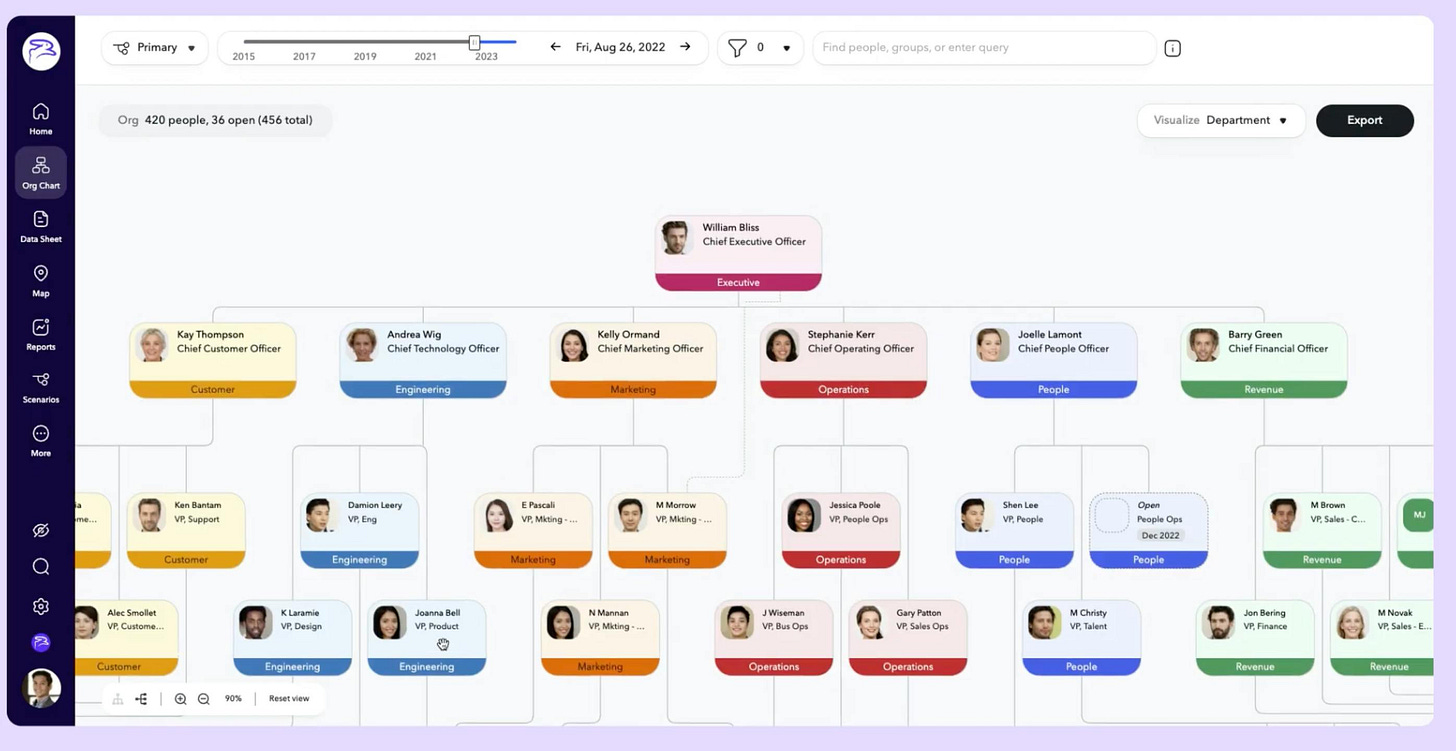

Alongside providing data analytics, ChartHop enables organizations to create org charts that automatically update. These charts can include personal details like employee location, hobbies, and other characteristics enabling company leaders to gain a holistic overview of their employee base. The charts leverage ChartHop’s integrations with payroll data and ATS systems to also show open roles and provide a visual of a company’s team structure.

Like most of its features, ChartHop’s org charts support revision control, thus letting companies view how their org chart has changed over time, as well as plan for future changes. For example, companies can link their org chart to their ATS and forecast how new roles will impact the balance of their existing team. ChartHop also enables scenario planning, so companies can compare the cost and impact of proposed headcount and raise plans by simulating scenarios. Since all of this data is accessible company-wide, recruiters can also leverage it to know exactly what departments to begin hiring for and to automatically update open jobs with new hire details.

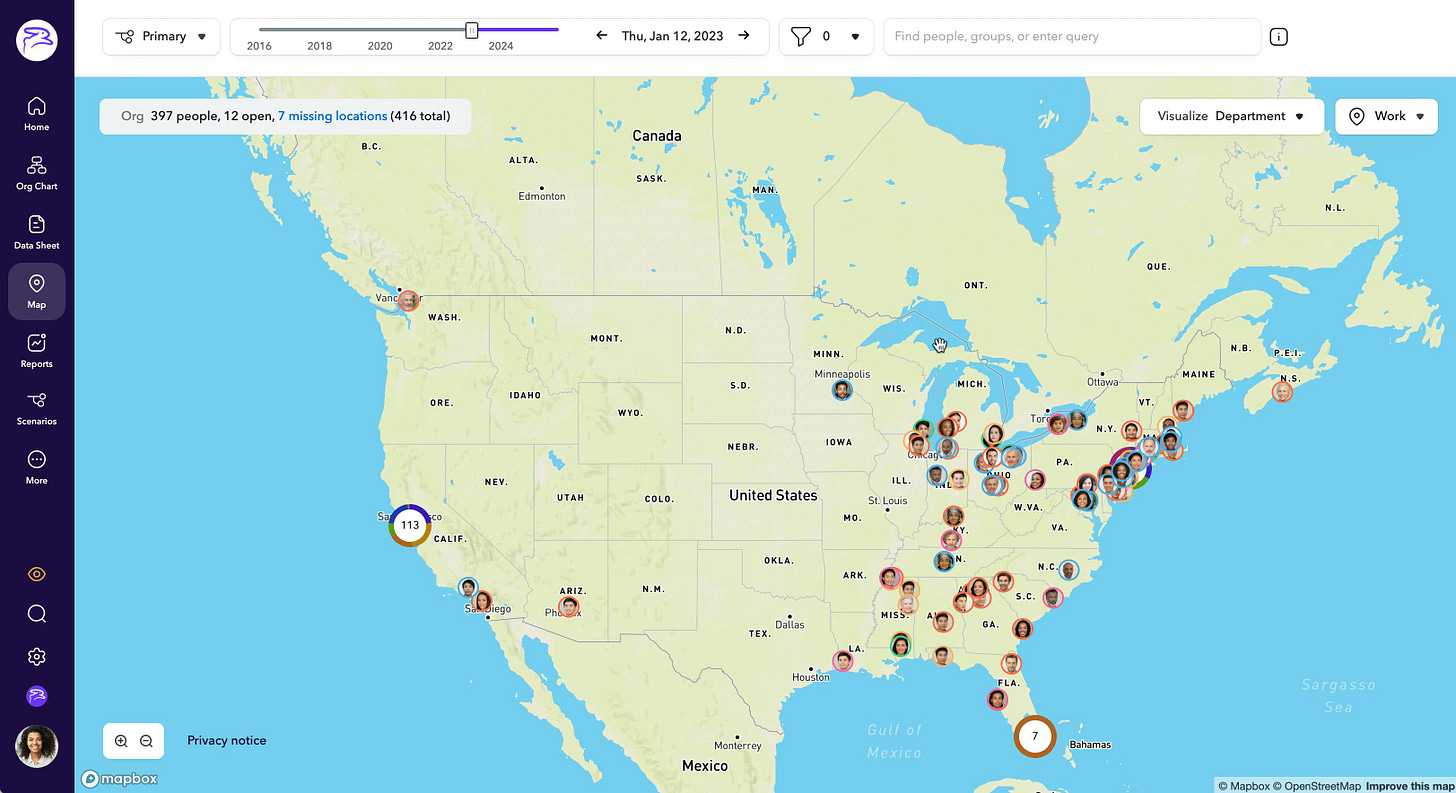

In addition to org charts, companies can also view their employee base on a global map to visualize their company. When paired with filters, recruiting leaders can analyze the spread of specific departments around the world to forecast where future hiring efforts may be needed. To this end, the map view enables remote-first companies to accurately track where their employees are based as they scale, helping companies increase employee engagement by planning in-person events and retreats.

Headcount Planning

ChartHop's Headcount Planning tool is meant to enable teams to streamline planning as they scale. It allows managers, executives, HR, and finance to align on headcount plans as they scale without having to rely on multiple separate spreadsheets being used by each hiring manager to create and manage their own hiring plans.

Using the Headcount Planning tool, HR teams or leaders within the org can create individual scenarios for hiring. This begins with ChartHop’s Org Charts which visually displays the organization and any relevant people data.

For example, if a leader wanted to expand the headcount on their team for the new year, they would have an access-controlled part of the Org Chart that only shows what information they’re allowed to see, such as performance data, compensation, and last raise, to enable data-driven headcount plans.

This would enable them to propose promotions based on performance data with a few clicks, change employees’ titles or comp bands, or make salary or equity adjustments to existing employees. It can also be used to change the reporting structure of an org and add headcount to report to an existing manager. Once a scenario has been designed, it can then be shared with collaborators who can then review the plan, make adjustments, and leave comments. Once complete, the scenario can be enacted via ChartHop’s integrations to the company’s ATS and HRIS.

Engagement

ChartHop’s Engagement product enables companies to conduct employee engagement surveys and 1:1 employee feedback forms. The product is intended to be used for ad-hoc employee feedback that may take place outside of quarterly or annual performance cycles, to more easily gauge employee sentiment across a workforce, and to measure employee engagement data quantitatively. Survey results can be displayed in a real-time dashboard. The goal is to reduce the friction of managing feedback and to enable the promotion of a culture of feedback.

Compensation Reviews

With ChartHop’s access to company-wide data, it is able to help managers plan merit raises by providing an overview of performance ratings, equity, compensation, salary history, bands, and more. This is intended to reduce bias in compensation, and also to ensure that employees who are potentially being unfairly compensated can be flagged, reducing the likelihood of employee churn.

With compensation reviews, companies can create approval workflows, distribute manager workbooks, and sync data with their financial planning and analysis (FP&A) systems, such as Workday Adaptive Planning, to collaborate with finance teams on compensation plans. Further, companies can leverage the data that ChartHop has to streamline their performance reviews by actively tracking key data points regarding employee performance, compensation, work history, and more.

Integrations

ChartHop allows users to integrate data from numerous other systems and apps into one unified platform, and can automatically update org charts, maps, reports, and even spreadsheets once the appropriate integration is set up. Notable integrations supported by ChartHop include BambooHR, Carta, Deel, Gusto, Lever, Workday, Zenefits, Slack, Okta, and Google.

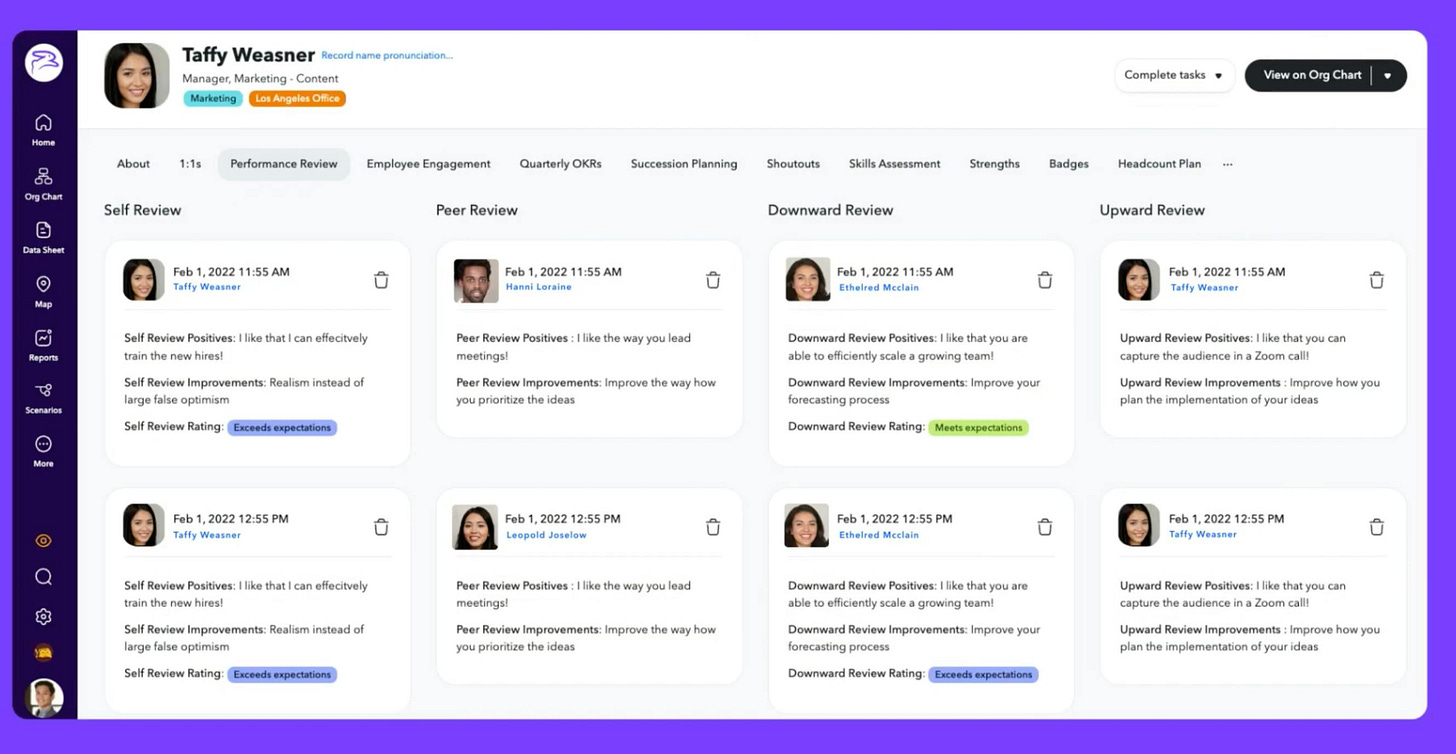

Performance Reviews

ChartHop’s Performance Reviews product is intended to simplify the performance review process by bringing performance reviews into the same platform as other people operations. Performance reviews can be viewed alongside performance data, and ChartHop records historical employee reviews in employee profiles. It also provides best practice templates and allows for automated reminders to complete performance reviews over Slack.

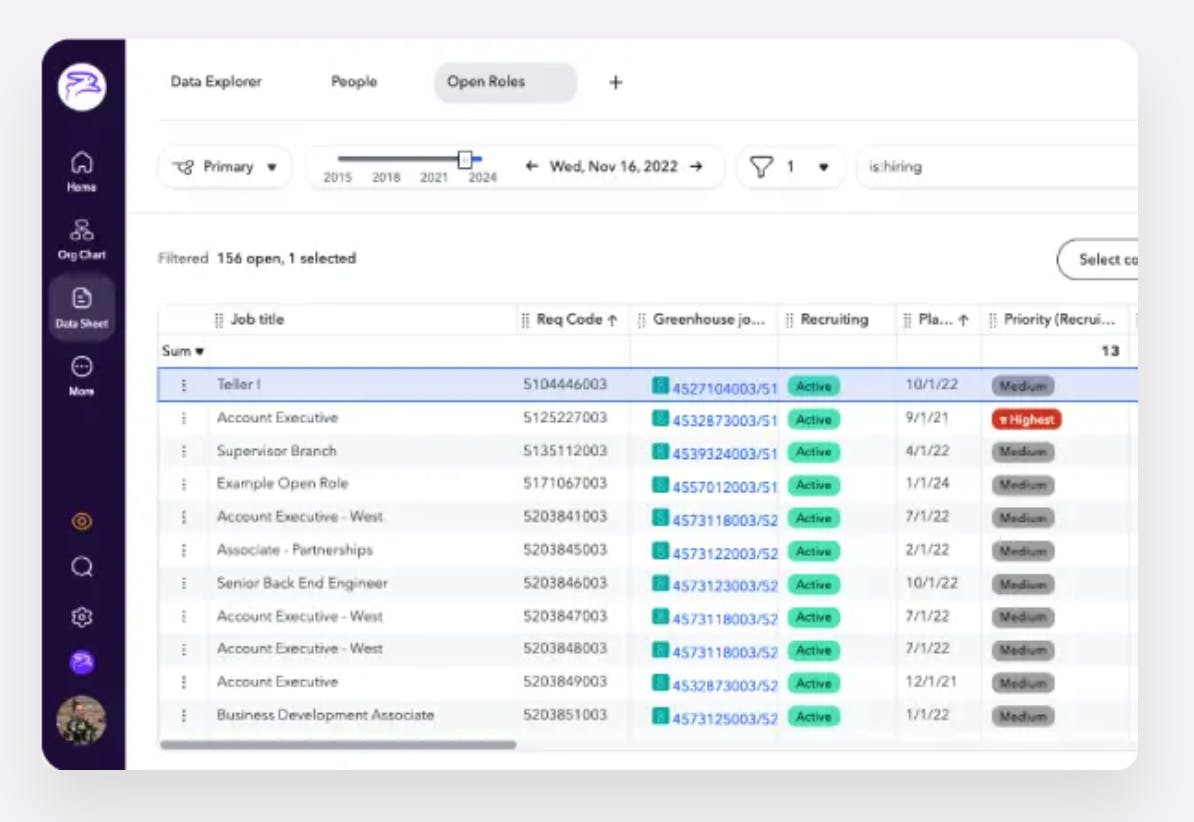

Recruiter Experience

ChartHop’s Recruiter Experience product allows users to give recruiters they are working with access to headcount plans, new hire data, and other ATS data. The tool is intended to enable better collaboration between different teams like finance, operations, and the hiring manager, and allows companies to automatically update open jobs with new hire details.

Market

Customer

ChartHop is built to work for companies of any size, from early-stage startups to large corporations with thousands of employees. Some of its core products such as headcount planning are especially designed for fast-growing organizations, and many of ChartHop’s early customers were small, high-growth companies struggling to properly forecast how changes in headcount would impact their underlying business.

ChartHop’s platform also lends itself to remote organizations whose employee bases are scattered across multiple geographies. For example, ChartHop is used by MongoDB whose 4K+ employees operate in a hybrid work environment.

ChartHop’s CFO, Matt Wolf described the customer demographic that ChartHop is targeting as follows:

"We like to think that any company with people is a good candidate for ChartHop. There is a certain size at which organizational planning/compensation planning becomes more challenging, so really kind of above maybe 100, 150 people is where we start hitting our sweet spot, but we can go into the multiple thousands and beyond”.

Notable customers that ChartHop lists on its website as of February 2024 provide evidence of the diversity of organizations that it targets.

Such customers include One Medical, Pepsi, Plaid, 1Password, PitchBook, and Mixpanel.

Market Size

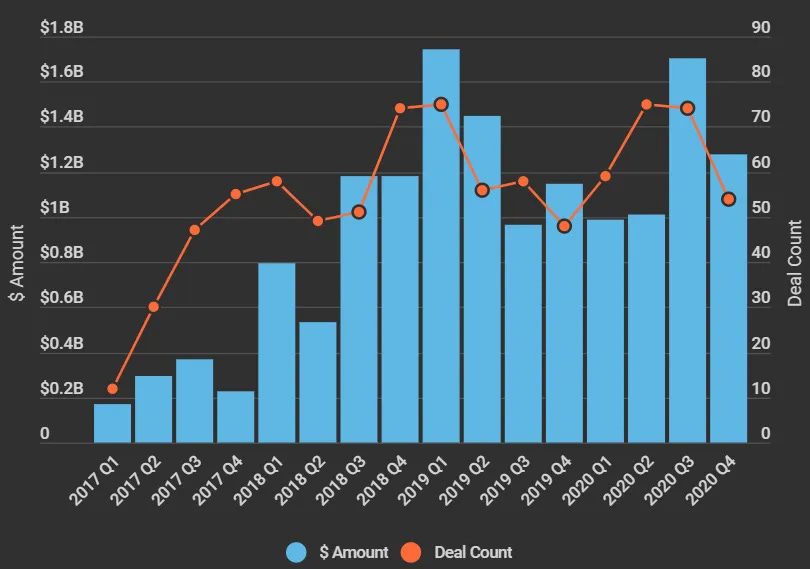

Since the pandemic, the market for HR tech has grown significantly. In 2021, venture investors invested over $12.3 billion into HR tech startups, ~3.5 times the amount invested in 2020. This increased investment continued into 2022, with over $1.4 billion being invested into HR software in the first two months alone.

This growth in HR tech isn’t limited to the US either; from January to June 2023, 15% of new European unicorns were HR software companies, compared to 4% in all of 2022. To this end, as companies are still grappling with changing workforce dynamics and adapting to remote work, the market for HR software to facilitate this workplace shift will continue to grow in 2023 and beyond. In terms of market size, one estimate predicts that the global market for HR software will be worth $38 billion by 2030, up from $23 billion in 2021.

While ChartHop operates across multiple segments within HR tech, from compensation management to employee engagement, its core product can be placed under the umbrella of “people analytics” – a segment that is projected to take up a large portion of the HR analytics market, worth $2.5 billion in 2020. One of the core drivers behind the growth in people analytics software is organizations’ inability to embed data analytics into their day-to-day HR processes. For example, a Deloitte report found that 75% of companies believe that using people analytics is “important,” but that just 8% believe their organization is “strong” in this area. Another report, led by McKinsey, also arrived at the same conclusion, affirming that while people analytics is a new domain, 70% of company executives already cite it as a top priority.

As a result, there is a growing demand for HR software that enables organizations to have a holistic overview of how their internal structure is evolving while planning and forecasting future scenarios, creating a market gap for ChartHop to fill.

Competition

Lattice: Lattice is a people management platform that specializes in performance management, employee engagement, and goal setting. Founded in 2015, Lattice has raised a total of $329.3 million as of February 2024, having raised a $175 million Series F round at a $3 billion valuation in January 2022. As of January 2024, Lattice was used by more than 5K businesses including notable companies like Slack, Gusto, Intercom, Ramp*, NPR, Calm, and Tide.

Similarly to ChartHop, Lattice provides organizations with tools to visualize their workforce through organizational charts and scenario modeling. However, while ChartHop primarily focuses on organizational planning and design, Lattice extends its reach into the realms of performance evaluation and employee development.

Visier: Visier is a people analytics and workforce management software that was founded in 2010. In June 2021, Visier raised a $125 million Series E at a $1 billion valuation which brought its total funding to $216.5 million. As of 2021, Visier processed employee records for 8K customers, including Adobe, BASF, Bridgestone, Electronic Arts, McKesson, Merck KGaA, and Uber. These companies collectively represented 12 million individual users across 75 countries for Visier.

Like ChartHop, Visier enables organizations to have a visual overview of their workforce and model the impact of future hiring scenarios. However, while ChartHop is largely focused on people operations (via organization charts), Visier also offers products such as Corporate Sustainability Reporting Directive (CSRD) reporting to ensure customers are compliant with regulations.

AgentNoon: AgentNoon is a workforce planning and organizational design software for global teams. Founded in 2021, AgentNoon raised $500K via YC’s W22 batch. AgentNoon integrates with 80+ data sources to let companies visualize and plan their organizational structure via org charts. It also enables teams to build operating models to estimate the cost of pursuing different organizational changes. In terms of pricing, AgentNoon doesn’t charge an implementation fee but instead charges $299/user/month. This contrasts with ChartHop, which charges $8/user/month but with a high initial implementation fee. AgentNoon describes the difference between both software platforms as follows:

“ChartHop lacks focus, attempting to cover a wide range of features without excelling in any specific area. This results in a diluted user experience and reduced efficiency. Agentnoon as a ChartHop alternative has a dedicated approach to org design and workforce planning.”

15Five: Founded in 2011, 15Five is a performance management tool that lets HR managers measure team engagement, performance, and retention. In July 2022, 15Five raised a $52 million Series C led by Quad Partners with additional funding from previous investors Next47, Origin Ventures, Edison Partners, Matrix Partners, Point Nine Capital, and New Ground Ventures.

As of 2022, 15Five is used by 3.4K companies, including Credit Karma, Spotify, and Pendo. Similar to ChartHop, It primarily targets businesses with between 100 and 2.5K employees. However, while ChartHop offers solutions for people leaders to create org chats and model scenarios, 15Five is mainly focused on talent & performance management solutions, such as OKR tracking and manager-employee feedback tools like 1-on-1s and pulse ratings.

Alongside these key competitors, there exists a plethora of companies competing with ChartHop in key areas, from employee engagement to headcount planning. Some examples include Team Ohana, Knoetic, EmployeeCycle, and Beamery.

Business Model

ChartHop offers four standalone modules that users can pick based on their needs. ChartHop Basic, which is free to try for teams under 150 employees, allows for the use of ChartHops Org Chart Product, Maps, several integrations, and a dashboard. Pricing for companies with greater than 150 employees, or that are looking to access ChartHop's full functionality, is not publicly disclosed and must be requested individually.

On top of charging companies by the number of users/employees, ChartHop requires a minimum annual contract and a one-time implementation fee for its Standard and Premium plans. The Standard plan’s minimum is $12K while the Premium plan’s minimum is $19.2K

Below is a visual breakdown of ChartHop’s pricing model:

Traction

ChartHop grew from 30 employees to over 140 in 2021, and in 2022, it reached 190 employees. Yet its pace of hiring has since slowed, with Ian White stating that ChartHop has ~150 employees in a May 2023 interview. This indicates that ChartHop has downsized following the great tech reset of the last year.

In terms of revenue and user growth, in January 2023, ChartHop announced that its revenue and number of active users had grown 4x since June 2021. Its number of paying customers also grew by 3x during that same period. Further, Inc. revealed that ChartHop ranks in the top 1% of America’s fastest-growing private companies with a three-year revenue growth of 8,010%.

Given that ChartHop previously had 130+ customers in 2021 (including Plaid, Lightspeed, Starburst, and InVision), it can therefore be estimated that ChartHop is currently being used by ~450 paying companies (applying the same 3x growth multiple), ranging from early-stage startups to large enterprises.

Valuation

In January 2023, ChartHop raised a $20 million Series C round led by Cox Enterprises with participation from Andreessen Horowitz, who also led all of ChartHop’s prior rounds. The round brought ChartHop’s total funding to $74.1 million. Although no press release disclosed a valuation, PitchBook placed its post-money valuation at $260.1 million.

ChartHop’s Series C round size was smaller than its Series B when it raised $35 million at a reported post-money valuation of $335 million in June 2021. This fall in round size and valuation may have been due to a wide-scale drop-off in tech valuations in the intervening period due to macroeconomic conditions. These conditions impacted HR tech startups significantly, with reduced hiring counteracting the need for HR software. For example, the number of firms that cut back their spending on HR software in 2023 increased from 5% to 8%.

CEO Ian White described ChartHop’s Series C round as follows:

“It’s no secret that this is a tough fundraising market. SaaS valuations are down, firms are reluctant to deploy capital, and many companies may be forced to raise capital on structured terms that can significantly impact employee equity. Ultimately, this round enables us to keep delivering the best product for our customers.”

Key Opportunities

Leveraging AI

With the recent advancements in AI, there are significant opportunities for HR technology companies to embed AI into their products. By leveraging AI, instead of relying on raw data analysis to derive insights, HR platforms can now enable people leaders to predict employee retention, recruitment, and learning outcomes with increased accuracy. Through this, team leaders can draw stronger insights from data, leading to more informed decision-making processes that benefit the overall performance of an organization.

Building Tools for The Global Workforce

As of June 2023, 12.7% of full-time employees worked from home, while 28.2% of employees had fully adapted to a hybrid work model. By 2025, an estimated 32.6 million Americans will be working remotely, which equates to around 22% of the workforce.

Given the continuing demand for flexible working environments, companies are being forced to adapt, requiring them to change their internal processes. However, the current tools companies have to manage their organization aren’t purpose-built for remote teams. This presents an opportunity for ChartHop to leverage its access to company-wide data and build new features that give people leaders increased insight into their internal structure. For example, ChartHop can enable companies to compare how productivity differs by region and compensation, allowing teams to focus hiring efforts on specific regions.

Key Risks

Data Security

As ChartHop has access to confidential company-wide data, security is of paramount importance. Given this, ChartHop must ensure that its data storage processes are secure to gain the trust of large organizations. This challenge is exacerbated by an increasing number of cyberattacks due to AI. For example, an August 2023 report revealed that 75% of security professionals had witnessed an increase in attacks over the preceding 12 months, with 85% attributing this rise to bad actors using generative AI. Thus, the changing landscape of cybersecurity attacks means that ChartHop must continue to invest in improved security practices to prevent the risk of data leaks.

Economic Downturn

In 2023, 25% of HR budgets decreased, compared to 12% in 2022. Further, 28% of leaders said their budgets have remained stagnant year over year, despite rising costs. As a result, HR budgets were shrinking, resulting in cost-cutting and the elimination of nice-to-have software. This poses a challenge for the entire people analytics industry, especially as the benefits of HR software are largely intangible. ChartHop will have to navigate a challenging business environment as it attempts to continue to grow.

Summary

Over the past few years, the workforce has changed dramatically, and the HR tools needed to support this shift have grown in both importance and demand. ChartHop is one of the many startups that have benefitted from this shift, helping organizations unlock previously hidden insights by connecting disparate data sources together. As a result, ChartHop has placed itself as a leader in the people operations space, helping pave a new category in HR focusing on people operations and management.

But, as we enter a post-pandemic world with increasing layoffs and internal HR budgets falling, people operations companies like ChartHop will now have to overcome barriers to ensure that they not only acquire new customers but retain existing ones. Yet, while the criticality of people operations software will be put to the test, ChartHop is well-positioned, given its early success with customer acquisition, to overcome such challenges and take advantage of changing workforce dynamics to help company leaders better plan and prepare for the future.